This is the story of how I learned to love the “B word.”

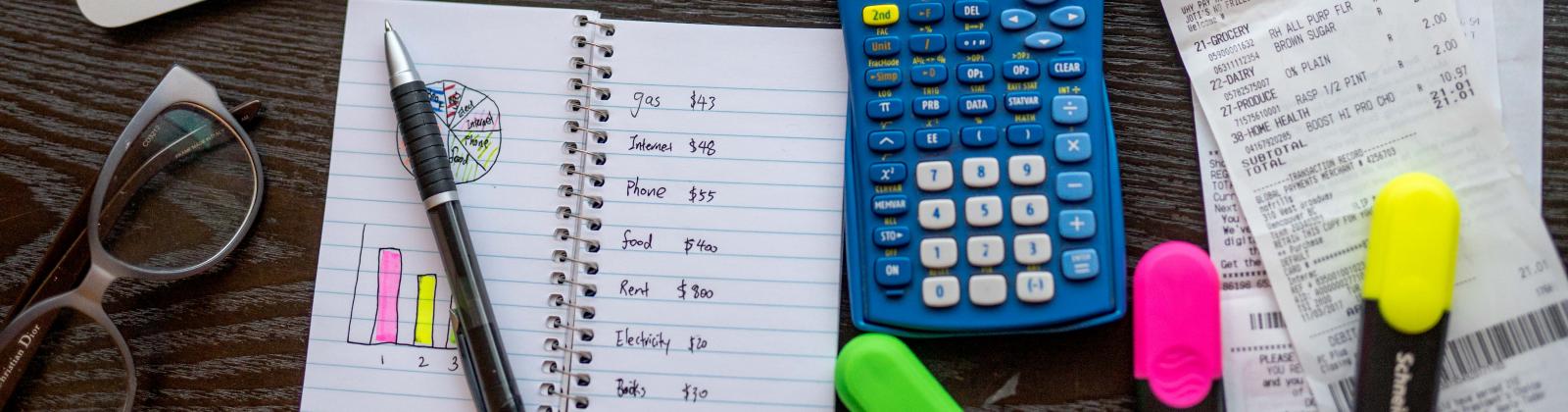

Budgeting has never really been my thing. As in, I’ve never really made one. Unless you count those few times I scribbled various amounts of money on a piece of lined paper under two columns labeled ‘Income’ and ‘Expenses,’ with reckless disregard for whether those amounts actually corresponded with reality. Somehow—pure luck? A divine act?—I survived the past 10 years of living on my own without one.

But all that changed last term. After attending a Financial Wellness workshop held by UBC Enrolment Services, I was inspired to make a comprehensive budget for the first time. And luckily, I did. Otherwise, I might have made some ill-advised financial decisions that would have left me in dire straits for the rest of my university career and beyond.

Pitfalls of haphazard money management

As I mentioned, I’ve lived on my own for the past 10 years. After spending 5 of those years completing my undergraduate degree, I spent another 5 living abroad. During that time, I managed my money through what can be generously referred to as ‘haphazard planning.’

When a big event was coming up, such as a vacation or a big concert, I would put together a short-term plan for how I was going to afford it. I would tighten my belt temporarily and work towards achieving that goal. Once the event passed, I would go back to my regular habits. Work. Save. Spend. Repeat. While I was certainly not living a life of extravagance, I did not have a budget and was not tracking my spending.

As a result, I didn’t have a clear long-term financial goal in mind. I was susceptible to making impulsive spending decisions. I was spending too much and not saving enough. Now that I’m a student again, short-term planning doesn’t cut it anymore. When you’re bringing in money regularly, it’s easy to ignore your finances and live without a budget. Students don’t have that luxury. If you don’t budget, you’re likely to spend more than you need to at a time when you’re on thin financial ice.

The Managing Your Budget workshop a.k.a. My wake-up call

At the budgeting workshop, Enrolment Services Advisors stressed the fact that financial health is tied to overall wellbeing and shared a number of tips for managing student finances.

After the workshop, I decided to put some of their suggestions into practice. So I went home and made a budget for the year. Using a simple budget planning worksheet, I diligently tallied my savings and income for the year and subtracted my fixed and variable expenses. I made sure to be as accurate as possible, even with things that are hard to predict, such as entertainment and household expenses.

The result: a major wake-up call. Things aren’t as rosy as I thought they were in the Land of Ryan’s Finances. I realized that I need to make some major changes to my spending habits and practice disciplined saving if I’m going to survive the next year without going broke.

The importance of budgeting

After making my budget—and surviving the minor existential crisis it triggered—I learned 2 major lessons that I wish I’d discovered many years ago.

First, the biggest benefit of making a budget is that it gives you a clear picture of your finances, which helps you make smart purchasing decisions.

When you see how much extra money you have at the end of every month, it can help you distinguish between the things you need and the things you want. I was planning on making a number of big purchases, including a brand new bicycle and a digital camera, without knowing what financial shape they would leave me in. Now, after making a budget, I have a better idea of whether it’s wise to make these purchases. (Hint: I shouldn’t. Not yet, anyway.)

Second, budgeting helps you plan for the future. Knowing what you’re bringing in, what is going out, and when, allows you to get ahead of things and plan for when you might be strapped for cash.

In my case, I need to complete a 3-month internship this summer as part of my degree. That means a minimum of 3 months where I won’t be bringing in much money—a huge red flag if you aren’t sitting on a pile of gold. I had drastically underestimated the impact that this would have on my finances. This is something I need to plan for. If I hadn’t made a budget, it might have snuck up on me.

I am now laser-focused on my 2 main priorities: controlling my spending and making sure my current savings stretch as far as they can.

Don’t make the same mistakes as me. Get ahead of the curve and stay on top of your finances.

If you’re not sure where to start, talk to an ES Advisors or join one of their Financial Wellness Workshops. It's free so sign up today. Trust me—you'll be glad you did.