About the information on this page

This is not a legal document and may change without notice. Always refer to Canadian Revenue Agency for the most updated information.

This is not a legal document and may change without notice. Always refer to Canadian Revenue Agency for the most updated information.

An Individual Tax Number (ITN) is a unique number that Canada Revenue Agency (CRA) uses to identify you for tax purposes if you aren't eligible for a Social Insurance Number (SIN).

If you are an international student who is not eligible for a SIN, you need to get an ITN if:

| Topic | Details |

|---|---|

| When to apply | Well in advance, ideally soon after arriving in Canada |

| Cost | Free |

| Processing time | Generally 4 - 6 weeks (sometimes longer) |

| How to apply | Send your paper application to Ottawa, Ontario. The address is on the back of the application form |

| Application form | "Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents” [T1261] |

In addition to the application form, you will need to submit:

Please submit all of the following:

The photocopy of your passport must be notarized by a notary public, or certified by a professional, such as a lawyer, medical doctor, or chartered professional accountant. It must state that it is a true copy of the original, with the person’s name, title, address and phone number.

We suggest using Canada Post Xpresspost to mail your documents securely.

We highly suggest applying for an ITN from within Canada (e.g., before you leave Canada). If you have already left Canada and you need to apply for an ITN, we suggest you include a cover letter explaining your situation to avoid confusion and delay. You may call the Canada Revenue Agency's International Tax office before submitting your application to ensure your application contains sufficient documentation. You can call the Sudbury Tax Centre numbers below to check you are providing the right documents before sending your application.

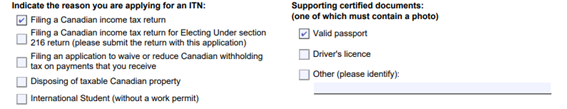

Indicate "Filling a Canadian income tax return" as the reason you are applying for an ITN.

The “Foreign Address” refers to your address in the country where you permanently or normally reside. The “Mailing Address” refers to a Canadian address to which the CRA will send the written notification of your ITN.

If you don’t have a Foreign Tax Identification number, you may write “N/A”.

You should be the one providing your signature. The person certifying your document, such as your doctor, should sign and certify the photocopy of your passport.

Can I work with an ITN?

No. To start working in Canada and receive benefits from employment, you need to apply for a Social Insurance Number (SIN) to replace your ITN and be eligible to work in Canada.

Does an ITN expire? Do I have to renew ITN?

No. The ITN does not have an expiry date and once you are issued an ITN, you can use it for future tax filing purposes. But remember that if you get a job in the future, you will need a SIN.

If I lost my ITN or need to make changes to my personal info, should I apply for a new ITN?

No. You must contact the Canada Revenue Agency (CRA) to notify them about the lost ITN or changes to your personal information. You can then either get your previous number re-issued or keep using the number you have.

I am outside Canada. Can I get my documents certified by a notary or professional outside Canada in order to submit my ITN application on time?

Yes.

For questions about the ITN, call the Sudbury Tax Centre:

Contact International Student Advising for questions related to immigration, health insurance, and life as an international student in Canada.